White House floats historically huge tax reform plan

Trump administration releases broad outline for tax code overhaul

WASHINGTON—The Trump administration released its blueprint for overhauling the tax code Wednesday, calling it the largest tax reform in the history of the Unites States.

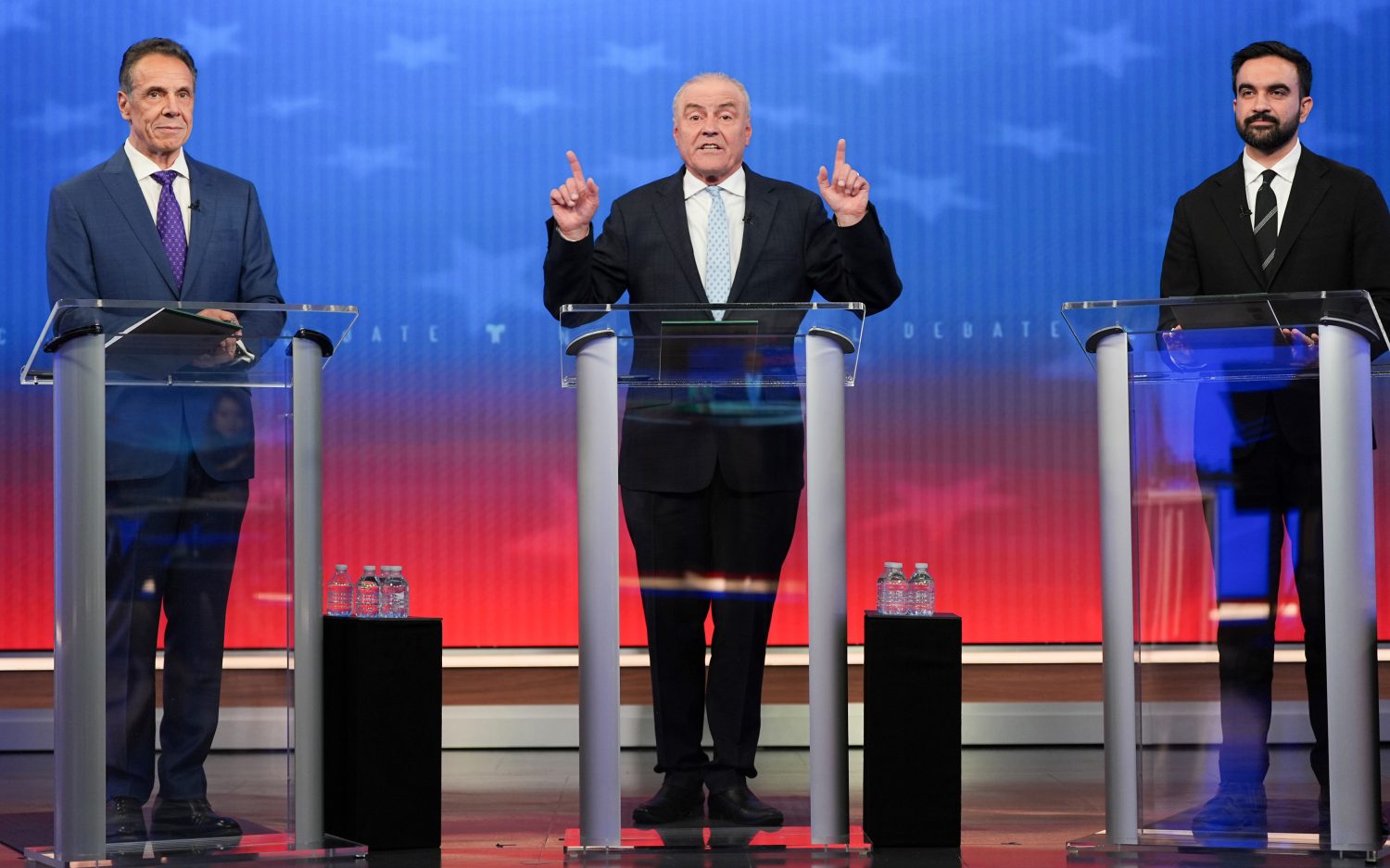

President Donald Trump’s chief economic advisor, Gary Cohn, and Treasury Secretary Steven Mnuchin outlined core principles for new tax reforms in a broad, one-page outline. They want to slash the corporate tax rate from 35 percent to 15 percent and reduce the number of income tax brackets from seven to three. They also want to abolish the death tax and the alternative minimum tax altogether.

Trump’s officials said they are in the middle of robust discussions with leaders in Congress to translate the ideas into a passable bill that can make it to the president’s desk. But if successful, Cohn claims this will be the most significant tax reform legislation since 1986 and one of the biggest tax cuts in American history.

“We have a once-in-a-generation opportunity to do something big and important on taxes,” Cohn said.

The pieces are in place to make significant reforms to the tax system since it is one of Trump’s top priorities and Republicans in Congress are eager to cooperate.

Many of the proposed plan’s key details remain under wraps, but Mnuchin and Cohn said they have been working on it for a considerable amount of time and will release more particulars when negotiations progress further.

Mnuchin, Cohn, and other top Trump administration officials met with several Republican congressional leaders Tuesday evening to brief them on the plan and ensure both parties are on the same page before the rollout.

House Speaker Paul Ryan, R-Wis., told reporters before the White House release that a final tax reform product is within view.

“We’re in agreement on 80 percent, and then that 20 percent, we’re in the same ballpark,” Ryan said.

The Trump tax plan makes several sweeping changes to both corporate and individual tax structures. The plan proposes creating a top individual tax rate of 35 percent and only two lower income tax brackets, 25 and 10 percent respectively.

Cohn would not reveal what income levels will qualify for each new bracket, citing ongoing discussions. But he said Trump felt it was important to outline broadly his vision for a simplified tax code.

The plan also nearly doubles the standard deduction taxpayers can use to diminish their household taxable income. It raises the deduction for married couples from $12,600 to $24,000—making that first part of married couples’ income tax-free.

Republicans are currently negotiating among themselves to pass healthcare legislation using the reconciliation process, which expedites legislation and allows it to advance in the Senate on 51 votes instead of the normal 60-member threshold to end debate. But they can only use this once per fiscal year.

That means if Republicans want to pass tax reform using reconciliation, they will have to wait for a new reconciliation window in September when the current fiscal year ends. Mnuchin said Wednesday they are ready to use the reconciliation process if Democrats attempt to stonewall progress.

Senate Minority Leader Chuck Schumer, D-N.Y., voiced skepticism on the Senate floor Wednesday.

“We'll take a look at what they’re proposing,” he said. “But I can tell you this, if the president’s plan is to give a massive tax break to the very wealthy in this country—a plan that will mostly benefit people and businesses like President Trump’s—that won’t pass muster with we Democrats.”

Schumer said a 15 percent corporate tax rate will further stuff the pockets of the country’s wealthiest, leaving middle-class Americans to pick up the tab.

But Mnuchin said Trump’s plan is not about making the rich richer. It intends to surge economic growth by reducing the burden on small businesses. Under the plan, current small businesses structured at the top of the individual tax rate will be able to qualify for the new 15 percent threshold.

Fiscal conservatives have demanded a revamp of the tax system for years.

“President Trump has re-energized the drive for fundamental tax reform that creates growth and jobs,” Grover Norquist, president of Americans for Tax Reform, said in a statement. “Reducing taxes on all businesses down to 15 percent will turbocharge the economy.”

An actual newsletter worth subscribing to instead of just a collection of links. —Adam

Sign up to receive The Sift email newsletter each weekday morning for the latest headlines from WORLD’s breaking news team.

Please wait while we load the latest comments...

Comments

Please register, subscribe, or log in to comment on this article.