The weight of liability

Virginia's $18 billion in unfunded pension obligations are manageable, but will workers get all they expect?

are After nearly four decades of careless spending and unfunded obligations, state and local debt across the nation now tops an excess of one trillion dollars in unfunded healthcare and retirement liabilities.

Virginia's unfunded liabilities for all pension plans are pushing $18 billion. Its retirement system is considered safer than most and the state constitution guarantees that workers will get back all they contributed to their pension plans. Still, workers may not get all they expect.

"Some states are clearly more responsible than others," said Andrew Biggs, a resident scholar at the American Enterprise Institute and former Principal Deputy Commissioner of the Social Security Administration, during a conference call last week. "A number of states, in good times, have increased benefits without ever thinking, 'Hey, during bad times, we can't sustain this!'"

Following the conference call, Biggs testified before a House Oversight Committee that public sector workers receive a 33 percent premium compared to the private sector. He recommended that both state and federal governments consider reducing public sector benefits to levels comparable to the private sector on a gradual, "apples to apples" basis.

In Virginia, state officials have begun taking steps in this direction, though Gov. Bob McDonnell remains dissatisfied and is calling for more drastic efforts. The new budget proposal allocates $108 million in new funds for the Virginia Retirement System (VRS) and requires all public sector employees to contribute at least 5 percent of their income toward their pension plans.

"I didn't run for governor just to nip around the edges a little bit," Governor McDonnell said during a "Town Hall" meeting with the Richmond Times-Dispatch last week. "I really want to see some bigger, systematic changes. The companies that are most successful in the private sector are ones that talk about total quality management … That's what I want to see out of state government. I'm looking for big ideas."

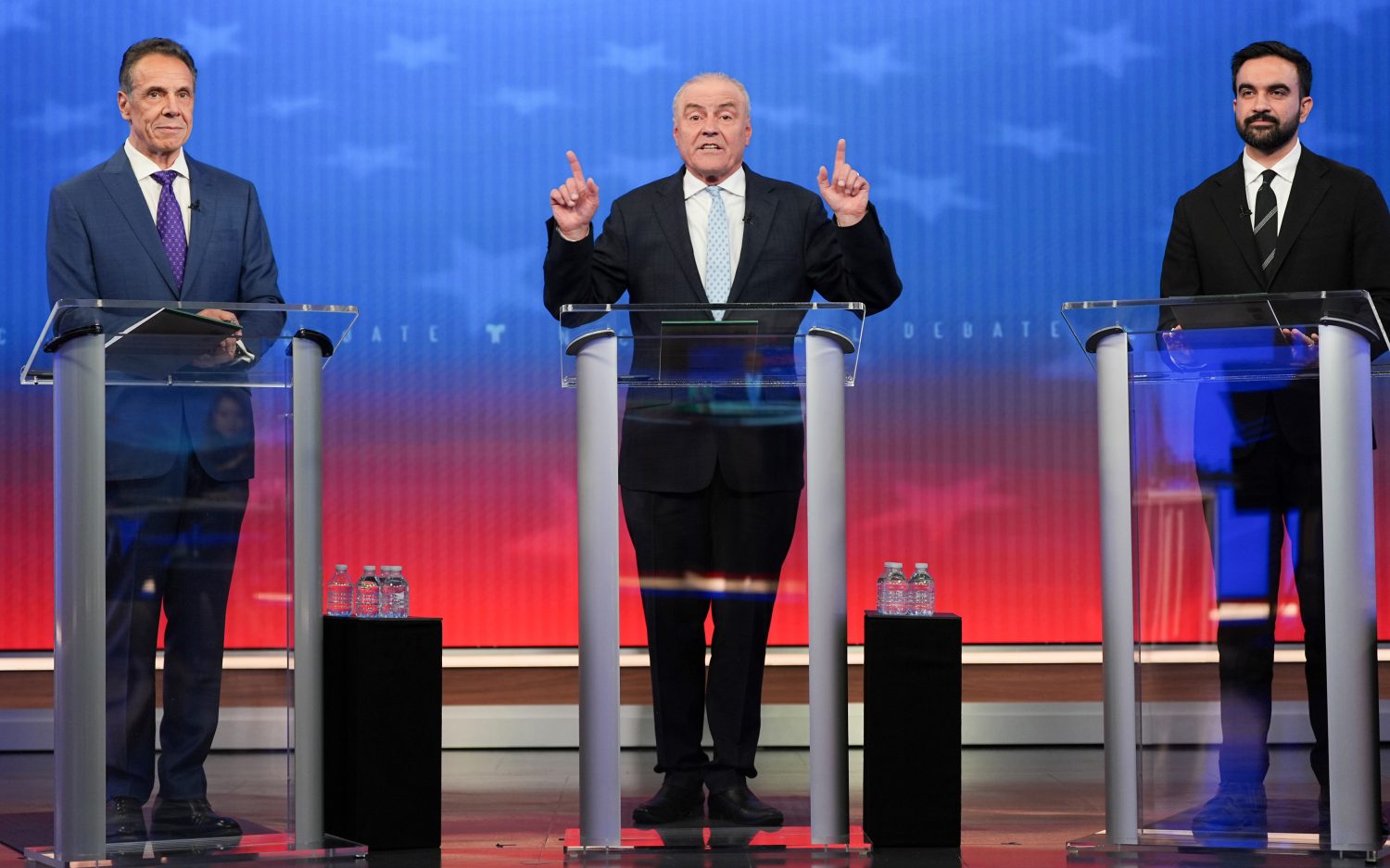

Responses to the pension crisis have varied from state to state, with some taking drastic action to curb spending and reduce debt (such as Wisconsin) and others seemingly paralyzed by the insurmountable weight of their liabilities (Illinois currently funds only 54 percent of its pension plan and .19 percent of its health care system, owing an excess of $94 billion in pension and healthcare liabilities). New York is currently the only state whose pension system is overfunded (covering about 107 percent of liabilities) while Virginia ranks somewhere in the middle, covering about 84 percent of liabilities.

The greatest concern among public sector workers across the country is whether the funds promised to them will exist when they decide to retire. "People will get back their money, but they won't necessarily get back as much as they thought they would," said Jagadeesh Gokhale, a senior fellow at the Cato Institute. "It is not very clear whether workers will receive everything they were expecting."

Gokhale explained that some states have constitutional protections built into their pension systems that guarantee whatever funds have been promised to public sector workers, regardless of the financial situation. Other states have no such constitutional protections, while others have something in-between.

In Virginia, the state constitution requires that all retirement funds be segregated into a "separate and independent" trust fund (see Article X, section 11), guaranteeing that state workers will at least get their contributions back. Also, government money contributed to the fund cannot be used for anything but the pension system.

However, this also means that if the retirement system is underfunded, the government can't be forced to pick up the slack. "Whatever has been contributed is safeguarded," Gokhale explained. "But [if the system is underfunded] the constitution, it seems, does not require the state to raise the necessary resources."

Most analysts believe that Virginia's pension debt can be easily fixed over the next decade, provided that state officials continue implementing government reform and emphasizing state accountability. For some states, however, it won't be so easy.

"The important thing is whether or not the state and local government is acting responsibly in putting the money away," said David John, a senior fellow who handles pension fund issues at the Heritage Foundation. "There is nothing inherently evil as far as pension policy goes - whether a state has collective bargaining or a traditional pension plan, or even something different - as long as it's handled responsibly, more than anything else, that's the factor."

"Like" us on Facebook today!

An actual newsletter worth subscribing to instead of just a collection of links. —Adam

Sign up to receive The Sift email newsletter each weekday morning for the latest headlines from WORLD’s breaking news team.

Please wait while we load the latest comments...

Comments

Please register, subscribe, or log in to comment on this article.