GOP takes aim at financial regulations

Republicans prepare to prune the Dodd-Frank Act

WASHINGTON—House Republicans unveiled new legislation this week to overhaul financial regulations implemented under the Obama administration.

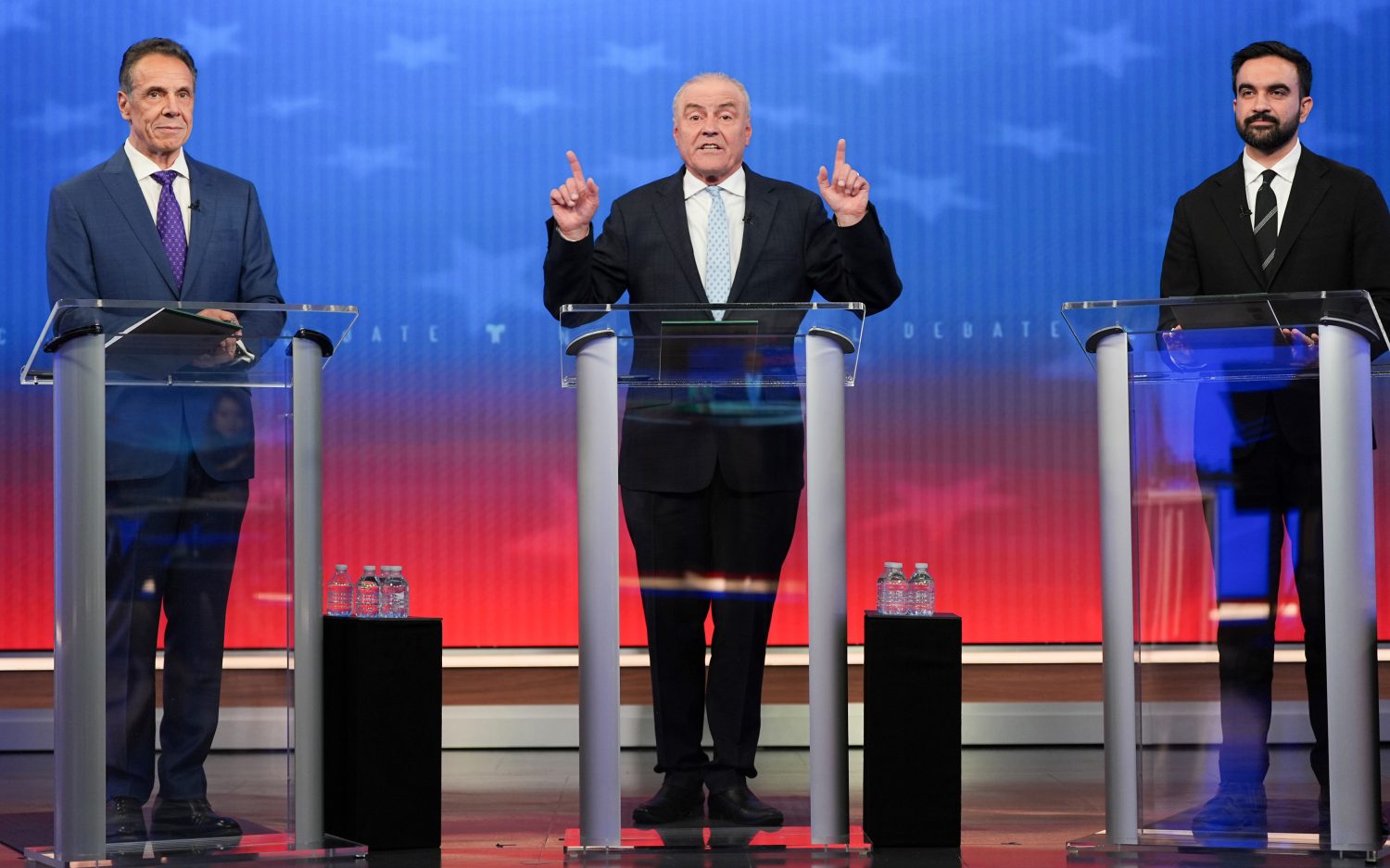

“We want economic opportunity for all, bailouts for none. We want real consumer protections that will give you more choices,” said Rep. Jeb Hensarling, R-Texas, chairman of the House Financial Services Committee, announcing the new draft legislation. “Supporters of Dodd-Frank promised it would lift the economy, end bailouts, and protect consumers. Yet Americans have suffered through the worst recovery in 70 years.”

Hensarling’s new 593-page bill seeks to dismantle many of the financial regulations applied under the Dodd-Frank Act, which congressional Democrats passed in 2010 with almost zero support from the across the aisle. Meanwhile, President Donald Trump plans to visit the Treasury Department today to sign three executive orders to reduce financial and regulatory burdens while Capitol Hill Republicans try to find a way forward for the contentious piece of legislation.

Last year during the height of the presidential campaign, Hensarling released a similar bill that passed out of committee but failed to get traction. Trump promised on the campaign trail to gut Dodd-Frank and began reviewing what executive rollbacks were possible in February. With a new anti-Dodd-Frank administration in the White House, this new bill—what Hensarling calls version 2.0 of the Financial Choice Act—is more ambitious than its previous edition.

Hensarling scheduled a hearing for lawmakers to discuss the new draft April 26.

As written, the opening offer from Republicans limits the powers of federal agencies such as the Consumer Financial Protection Bureau, which oversees financial products like mortgages and credit cards, and the Securities and Exchange Commission.

The bill would grant authority to the president to fire the director of the bureau at-will. Last year’s bill gave firing privileges to a five-member, bipartisan commission.

Hensarling said one of the main goals of the bill is to ensure federal bailouts of large banks are a thing of the past.

In one of President Barack Obama’s first major actions after taking office in 2009, he signed an $800 billion stimulus package to keep banks afloat and help stabilize the faltering economy after the Great Recession.

With new changes to the nation’s bankruptcy code, Hensarling claims large financial firms will be able to fail without disrupting the economy as a whole. And taxpayers won’t have to pay for bailouts.

The new bill also seeks to establish tougher penalties for financial fraud and illegal insider trading, which, in part, helped birth the 2008 financial crisis.

But Democrats in the House have already announced they oppose the bill and are sure to push back at the hearing next week.

“Simply put, the Wrong Choice Act bows down shamefully to Wall Street’s worst impulses, and would lead us back down the road to economic catastrophe,” said Rep. Maxine Waters, D-Calif., the ranking member of the House Financial Services Committee. “The new version, which is even worse than Chairman Hensarling’s first draft, cannot be allowed to become law. There is too much at stake for consumers and for our economy at large.”

If Republicans unite around the legislation, they have the numbers to advance it in the House. But without significant changes, it will struggle in the Senate, which needs support from 60 members to end debate. Republicans only have a 52-48 majority in the upper chamber.

But while lawmakers begin the uphill battle to get legislation onto Trump’s desk, the president is looking for ways to roll back financial burdens through executive action.

The White House announced Trump also will sign two memos Friday ordering six-month reviews from the Treasury Department of Dodd-Frank’s effect on financial regulators. The memos seek to find a way within the law to designate large financial firms as a risk to the overall system so federal regulators can shut them down without significant collateral damage.

Trump also plans to sign a new executive order Friday instructing Treasury Secretary Steven Mnuchin to scale back as many tax regulations as possible—focusing on ones that burden taxpayers or are too arcane to understand.

This will be on top of Trump’s February executive order asking Mnuchin and his staff to complete a review of ways to lessen burdens on businesses due in June.

An actual newsletter worth subscribing to instead of just a collection of links. —Adam

Sign up to receive The Sift email newsletter each weekday morning for the latest headlines from WORLD’s breaking news team.

Please wait while we load the latest comments...

Comments

Please register, subscribe, or log in to comment on this article.