Churches and taxation: An old tradition draws new opponents

The genesis of property tax exemption for churches goes back to the book of Exodus. During the time of the Old Testament, the Egyptians exempted their religious entities and priests from taxation by the pharaoh, according to attorney Frank Sommerville, a legal specialist who represents religious nonprofits.

“There was also the exemption under Jewish law from the time of Moses on that priests and the tabernacle was not taxed by any entity out there. And that continued all the way through the kings that were several hundred years later,” Sommerville said.

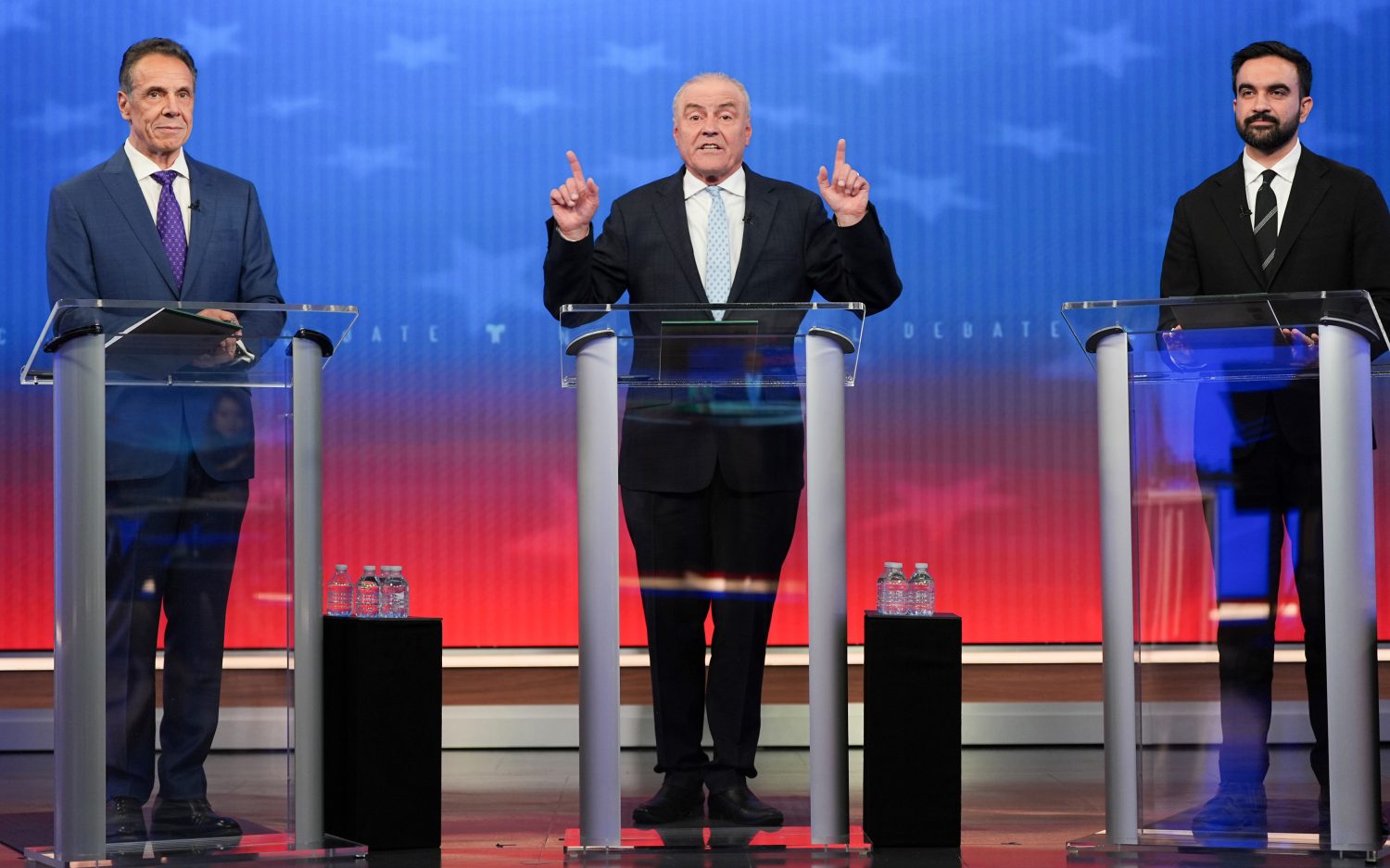

Despite its long history, church tax exemption continues to draw opposition from secular society. Most recently, John Oliver, who anchors a comedic newscast on HBO, ranted against it and formed his own religious organization to illustrate what he considers to be the absurdity of church tax exemption.

But Sommerville noted several justifications for relieving the church's tax burden, the first of which is that the charitable work of churches relieves the burdens of the state.

Another reason for church tax exemption is that, historically, the church was treated as a co-equal sovereign with the government.

“The church has existed before our federal government and the church will exist if there is no more federal government. It is a sovereign into itself. And so the sovereign—the government—does not have any authority to tax a fellow sovereign,” Sommerville said.

In 1969, the U.S Supreme Court considered the issue in Walz v. Tax Commission of the City of New York. New York City property owner Frederick Walz sued the tax commission because he thought it unfair that he paid property tax while churches did not. After all, the police and fire departments protected church property the same as they protected his. The only difference, as he saw it, was the churches paid nothing for those services and he paid plenty. To Walz, tax exemption was tantamount to an unconstitutional establishment of religion.

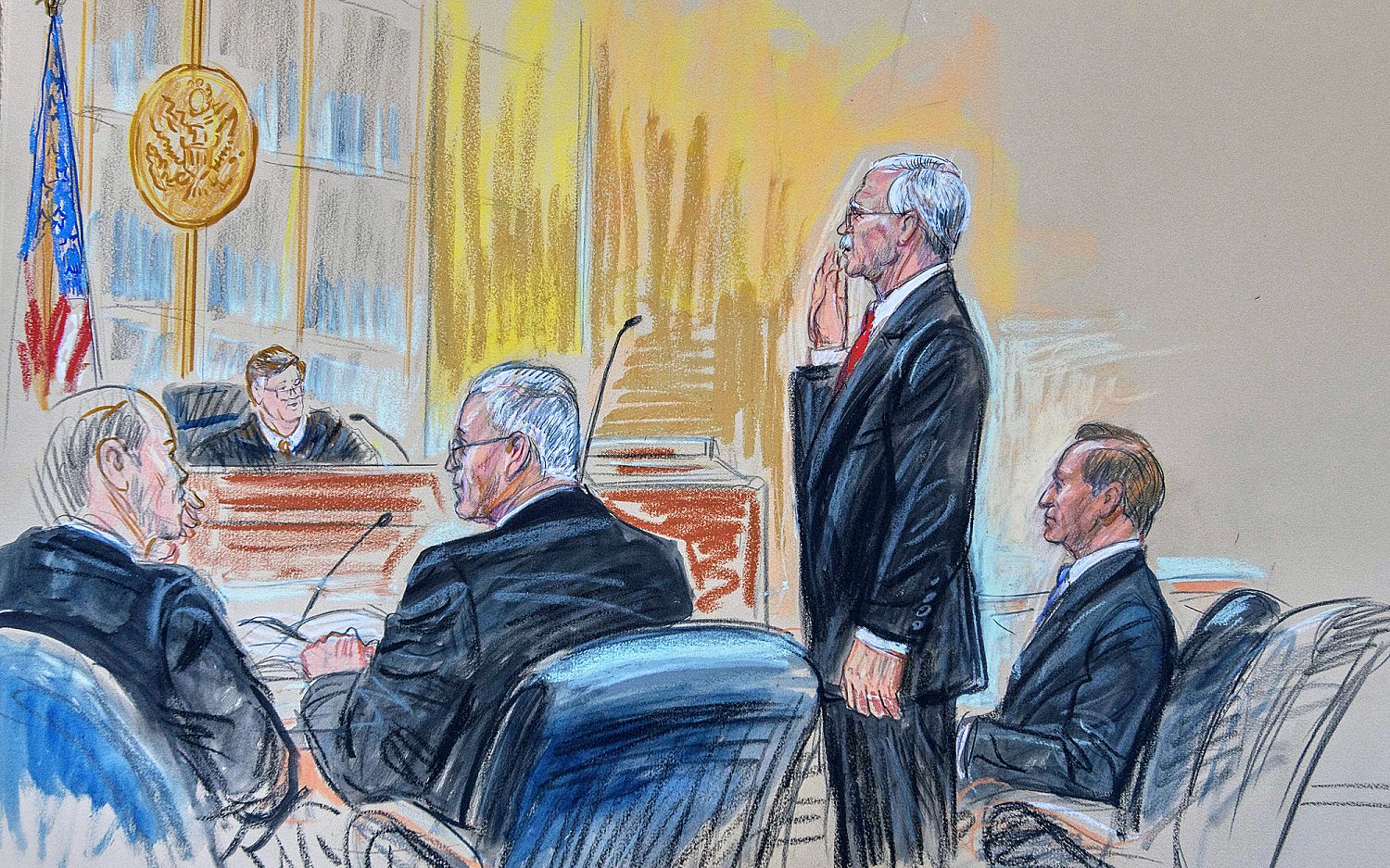

“It is our position, your honor, that if prayer and Bible reading in the public school is an aid to religion, it’s inescapable that the practical economic financial aid of real estate tax exemption is an aid to religion,” Walz’s attorney Edward Ennis argued. “This proposition is so simple that it is rather difficult to expand upon it. Its very statement is its own proof.”

Lee Rankin, the lawyer for the tax commission argued that, far from promoting neutrality, removing tax exemption would increase government involvement in religion.

“If you decide to sustain the appeal in this case, we are going to have government up to its ears in religion,” Rankin said.

In the end, the Supreme Court agreed with Rankin and ruled that exempting churches from property taxes created less entanglement with government than taxing them would. The court noted that for centuries, freedom from taxation had not lead to the establishment of a state religion, and that remains the controlling law today.

Listen to “Legal Docket” on The World and Everything in It.

An actual newsletter worth subscribing to instead of just a collection of links. —Adam

Sign up to receive The Sift email newsletter each weekday morning for the latest headlines from WORLD’s breaking news team.

Please wait while we load the latest comments...

Comments

Please register, subscribe, or log in to comment on this article.